Mileage 2025 - How to Calculate the Rate per km and Drive Correctly?

Introduction to mileage

Kilometric allowance is the reimbursement of the cost of using a private vehicle for business purposes, as specified in a decree of the Minister of Infrastructure. The regulation was introduced in 2002 on the conditions for determining and the manner of reimbursing the costs of using for business purposes passenger cars, motorcycles and mopeds not owned by the employer.

The rate per kilometer of vehicle mileage is set to cover costs associated with the operation of vehicles, among others: cars, motorcycles and mopeds not owned by the employer.

Accounting for the costs of private vehicles is based on the Decree of the Minister of Infrastructure of March 25, 2002. These regulations govern the reimbursement of costs for the use of private vehicles, including a private car, by employees and self-employed persons. The rates specified in the regulation are the statutory rate, per kilometer of vehicle mileage is clearly defined in the regulations and depends, among other things, on the engine capacity and type of vehicle.

Mileage records, commonly referred to as mileage records, are necessary to calculate reimbursement for vehicles used for work.

A company's deductible expenses, including the use of private vehicles including a private car, can be reduced by deducting the costs of using a private car or other vehicle for business purposes that are not owned by the employer. Accounting for these costs applies to both sole proprietors and employees who use private vehicles.

Types of vehicles and mileage rates for vehicles not owned by the employer

The rate per kilometer of vehicle mileage depends on the vehicle's engine displacement and type.

The rates set by the Minister of Infrastructure constitute the statutory rate. These regulations are crucial for accounting for vehicle use and deductible expenses, especially for private vehicles and passenger cars used for business purposes.

For private passenger cars with engine displacement up to 900 cc and other private vehicles, the rate is PLN 0.89.

In the case of a passenger car with an engine displacement of more than 900 cc, according to the costs and regulations, the rate increases to PLN 1.15 per kilometer of vehicle mileage.

The rates per kilometer of vehicle mileage are specified in the regulation and affect the accounting for deductible expenses and the company's cost of revenue and may change.

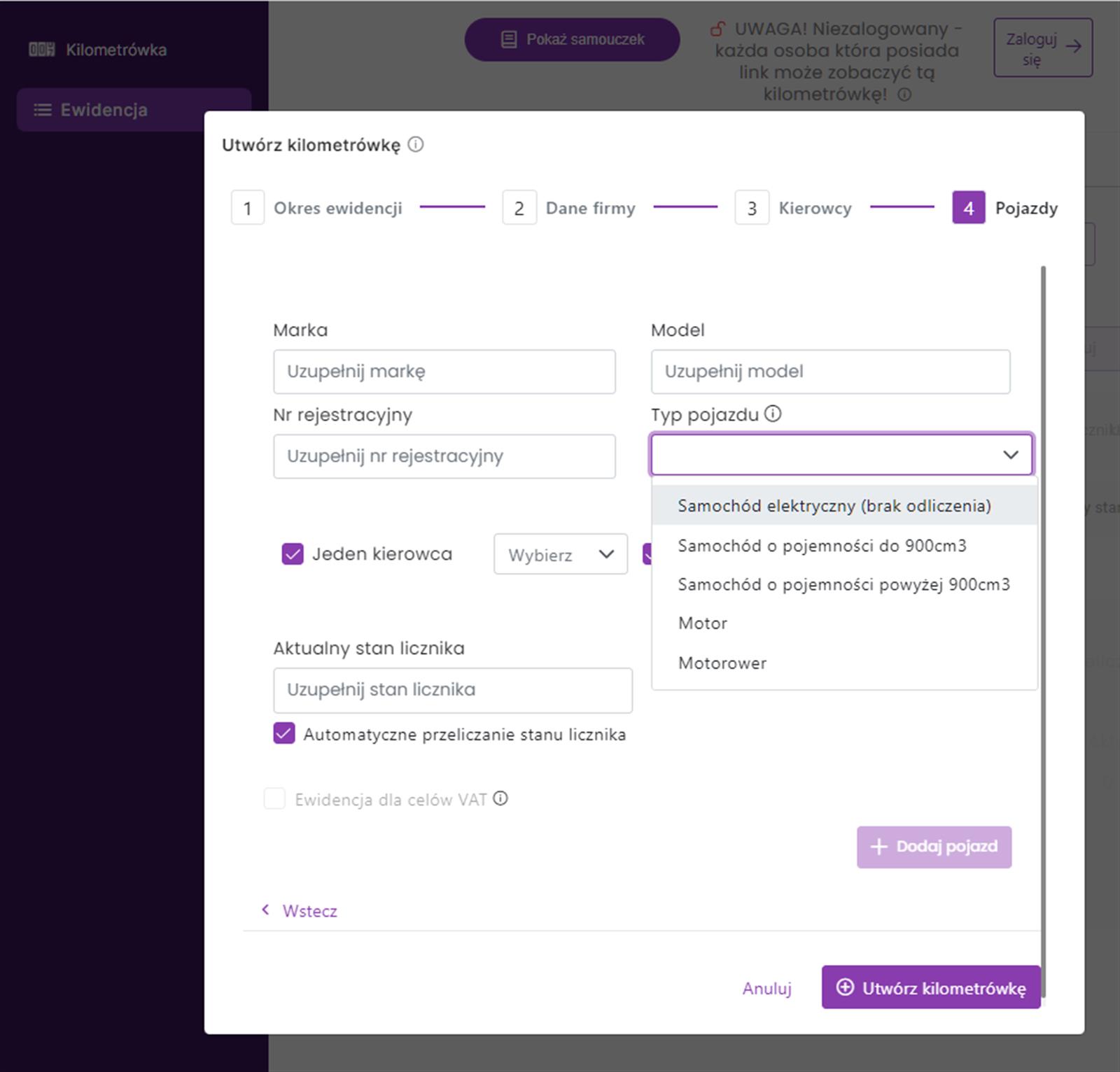

Using the program kilmetrowka.net All rates are charged automatically and you do not need to know the applicable values.

Vehicle mileage records

The records should include the date of departure and return, the purpose of the trip, a description of the route, the number of kilometers traveled and the type of vehicle.

The obligation to keep records applies in particular to hired employees who use private vehicles for business purposes, and the need to keep such records arises from tax regulations.

Records should be kept in a detailed and accurate manner to allow calculation of reimbursement for the use of a private vehicle under a contract with the employer.

In the case of a business or the use of such a personal car by an employee, the records are necessary for deducting deductible expenses.

The motor vehicle's registration number and engine displacement should also be included in the records.

Keep your records faster and more efficiently with kilometer.net.

How to calculate the rate per km of mileage

The rate per kilometer of vehicle mileage is calculated based on the number of kilometers driven and the rate specified in the decree of the Minister of Infrastructure.

To calculate mileage, multiply the number of kilometers driven by the rate specified in the regulation, and the final amount of reimbursement can be determined by the employer will decide on the basis of the contract concluded with the employee.

The employer may pay the employee a higher rate, but the excess above the statutory rate should be taxed and taxed.

If a private passenger car is used for business purposes, the employee may deduct deduct deductible expenses at the rate per kilometer of mileage, in accordance with the income tax regulations to which an employee under an employment contract is entitled.

The business trip should be documented through records.

Business activity and mileage

The activity may benefit from mileage as a deductible expense accounting for vehicles used in the company on the basis of kilometers driven. Such mileage should be performed at the end of each accounting period, i.e. at the end of a given month. Keeping such mileage has a significant impact on tax settlements and the value of income tax paid.

Vehicle mileage records are essential for deducting deductible expenses for business. Deduction of expenses, related to the vehicle for income tax purposes, can be carried out in two ways recovering half or 100% of the tax.

A vehicle can be used for business purposes, but it should be properly documented. Depending on the type of business, an entrepreneur can use different means of transportation and deduct the cost of a car, truck, motorcycle, moped, etc.

The day the record-keeping began and the day the record-keeping ended should also be included.

Every businessman has the right to account for expenses related to the use of a private car, and thus reduce the income tax he pays. Based on the kilometers driven, how much mileage is calculated in a given month.

Reimbursement for the employee

An employee may be reimbursed on the basis of records, commonly known as mileage. Keeping such mileage records is necessary when employees in a given company use their private cars for business purposes, an employee with an employment contract is entitled to reimbursement in accordance with applicable regulations. This reimbursement applies to the costs of using private vehicles, during a business trip, and settlement is based on the obligation to keep records. These costs may be included in the company's deductible expenses, and their amount depends on the engine capacity and the rates specified in the regulations - is the rate per kilometer of vehicle mileage in accordance with the statutory rate.

Reimbursement should be calculated based on the rate and number of kilometers driven. Business travel, such as meetings with clients or deliveries, also counts toward this statement and should normally be entered in the employee's mileage record.

The employee should keep records in a detailed and accurate manner so that reimbursement can be calculated.

The employer should pay reimbursement to the employee for the use of the vehicle to perform work, within the period specified in the contract.

Documents and evidence

Mileage records are necessary to calculate reimbursement for the use of private cars for business purposes.

The taxpayer's signature should also be included in the printed mileage. The lease agreement should also be included if a company vehicle is used.

The documents and evidence should be kept detailed and accurate to enable the calculation of reimbursement.

Using our program mileage.net monthly statements are stored in the cloud and you can access them at all times and from anywhere.

Penalties for miscalculations

Miscalculation of reimbursement for a vehicle for business purposes can result in fines and penalties.

The employer should keep mileage records in a detailed and accurate manner to avoid miscalculations. The mileage record of a particular employee should show the name, surname, address of the vehicle user, registration number, engine capacity, the next entry number, date, route description, purpose of the trip and the number of kilometers driven.

If the mileage calculation is found to be incorrect, the employer should make the correction and pay the employee the appropriate reimbursement.

Tax vat should also be considered for the use of a company vehicle.

Mileage rates

Mileage rates are set by decree of the Minister of Infrastructure and are subject to change.

The rate per kilometer driven depends on the engine displacement and type of vehicle. At the moment, the rate for a passenger car with an engine capacity of more than 900m3 is 1.15 per kilometer driven.

The maximum rates are set by the decree of the Minister of Infrastructure. The employer may set higher rates in a given mileage on its own, but they may not exceed the maximum rates set by the Minister of Infrastructure.

Mileage rates per kilometer should be included in the mileage records.

Using the kilometrowka.net program, you do not need to know the current mileage rates - they are constantly updated according to the current regulation. You do not need to check different rates for a passenger car, moped or motorcycle, because the rate base is always up-to-date.

Consequences of improperly kept mileage records

Improper record-keeping can have serious consequences for both the employer and the employee using vehicles for business purposes. First and foremost, errors or deficiencies in the records may result in the IRS questioning the right to deduct expenses related to the use of a passenger car, motorcycle or moped. In practice, this means that the company may lose the ability to deduct expenses incurred for kilometers driven, which directly affects the amount of income tax.

If the records do not contain all the required data - such as the number of kilometers traveled, the purpose of the trip, the route or the vehicle's license plate number - the authority may consider that the deductible expenses have been overstated or undocumented. This, in turn, leads to a tax surcharge or even additional financial penalties. An employee who does not keep records properly may lose the right to reimbursement for the use of a private car for business purposes, which reduces his real income.

To avoid such problems, it is a good idea to regularly check the mileage records for completeness and correctness of entries. Any irregularities should be corrected immediately and, if necessary, missing data should be supplemented or confirmation should be obtained from an employee or contractor. The introduction of internal procedures for checking records and the use of dedicated computer programs can significantly reduce the risk of errors and facilitate the settlement of deductible expenses.

Remember that properly maintained mileage records are not only a formal requirement, but also a tool to effectively manage your company's deductible expenses. This makes it possible to take full advantage of tax benefits and avoid unnecessary problems with the tax authorities. Attention to detail in the records is a guarantee of tax and financial security for both the entrepreneur and the employee using vehicles for business purposes.

Correct cost accounting in mileage

Correct accounting for the cost of using a vehicle for business purposes is essential to avoid miscalculations and penalties.

Road transport has additional mileage limits that must be taken into account when accounting for expenses. These limits apply to both deductible expenses and accounting for the use of private vehicles and private cars in business. The rate per kilometer of vehicle mileage has a direct impact on deductible expenses and on the correct accounting of deductible expenses in the company.

The employer should keep mileage records in a detailed and accurate manner so that reimbursement can be calculated.

If a company vehicle is used, the employer should take into account deductible expenses and make appropriate deductions.

The rate per km of vehicle mileage should also be included in the mileage allowance.

You need to know when you need mileage for income tax purposes and when you don't. Fortunately, our program - kilometrowka.net, answers all these questions and helps you complete this statement.