Mileage logbook - how to fill it in correctly?

Entering vehicle records for Vat purposes and more

A vehicle record is a document that proves the use of a car in business. It is required for income tax and purposes VAT. The main purpose of keeping such a statement is to recover costs incurred as a result of using private cars for business purposes, based on the number of kilometers driven and the rate appropriate to the engine capacity of the vehicle. The records are particularly important for vehicles used exclusively for business purposes, which is important for VAT settlements and the correct inclusion of expenses as business expenses.

It contains information about the mileage of the vehicle, including distances and dates of travel. Also important is the date the records began and ended, if any. Keeping mileage records is an obligation for entrepreneurs who use private cars for business purposes and those who manage a fleet of vehicles. The obligation to keep records also applies to accounting for local drives and the use of private cars in business.

Records of a vehicle, such as a passenger car, can be kept in paper or electronic form. Each must include the name, first name and home address of the person using it, the registration number of the motor vehicle to which the mileage applies and the number of kilometers actually driven.

Calculation of the amount is not difficult. You will do it with the formula: the amount of reimbursement = the number of kilometers*the rate for 1 km of mileage of a private car used for business purposes.

It is important to keep in mind the appropriate rate, which is set by the decree and corresponds to the engine displacement of the vehicle in question. Accounting for costs related to the operation of a private car and local drives requires taking into account the kilometers traveled and the corresponding rates set forth in the decree of the Minister of Infrastructure on the conditions for determining rates mileage. Proper record-keeping allows expenses to be included in business expenses and deductible costs.

Obligation to keep records

Entrepreneurs who want to deduct costs associated with the use of a car for business purposes, in business, must keep mileage records. As of 2019, under the amending regulations of the Minister of Infrastructure, not all entrepreneurs have to keep mileage records - this obligation has been reduced as a result of changes in the regulations. If an entrepreneur does not want to deduct 100% there is no need to keep records.

Records are required for taxpayers who want to deduct 100% VAT on car purchases and operating expenses. For a passenger car, the rates are 0.89 or 1.15 per kilometer for a private car with an engine capacity of more than 900cc.

This applies to vehicles used for business purposes, weighing up to 3.5 tons, which are used for business purposes. In this case, also motorcycles or mopeds not owned by the employer. Interestingly, keeping detailed records is not required for trucks. Proper record-keeping is also important when filing VAT returns, especially when the vehicle is used exclusively for business purposes.

Using the program kilmetrowka.net All rates are charged automatically and you do not need to know the applicable values.

Vehicle mileage records and their relationship to employees

The records should include information about the mileage of the vehicle, including the number of kilometers driven and the dates of the trip.

This information is to certify that the car is used for business. Each kilometer of vehicle mileage is calculated based on the established mileage rate contained in the regulation.

Accounting for local driving of a private car for business purposes requires keeping records in accordance with the applicable limits. If an employee uses his private car for business purposes at work, or any other vehicle, he should also keep mileage records. He should also draw up in the case of business trips, if he wants to settle with his employer in connection with the use of a private car During a business trip.

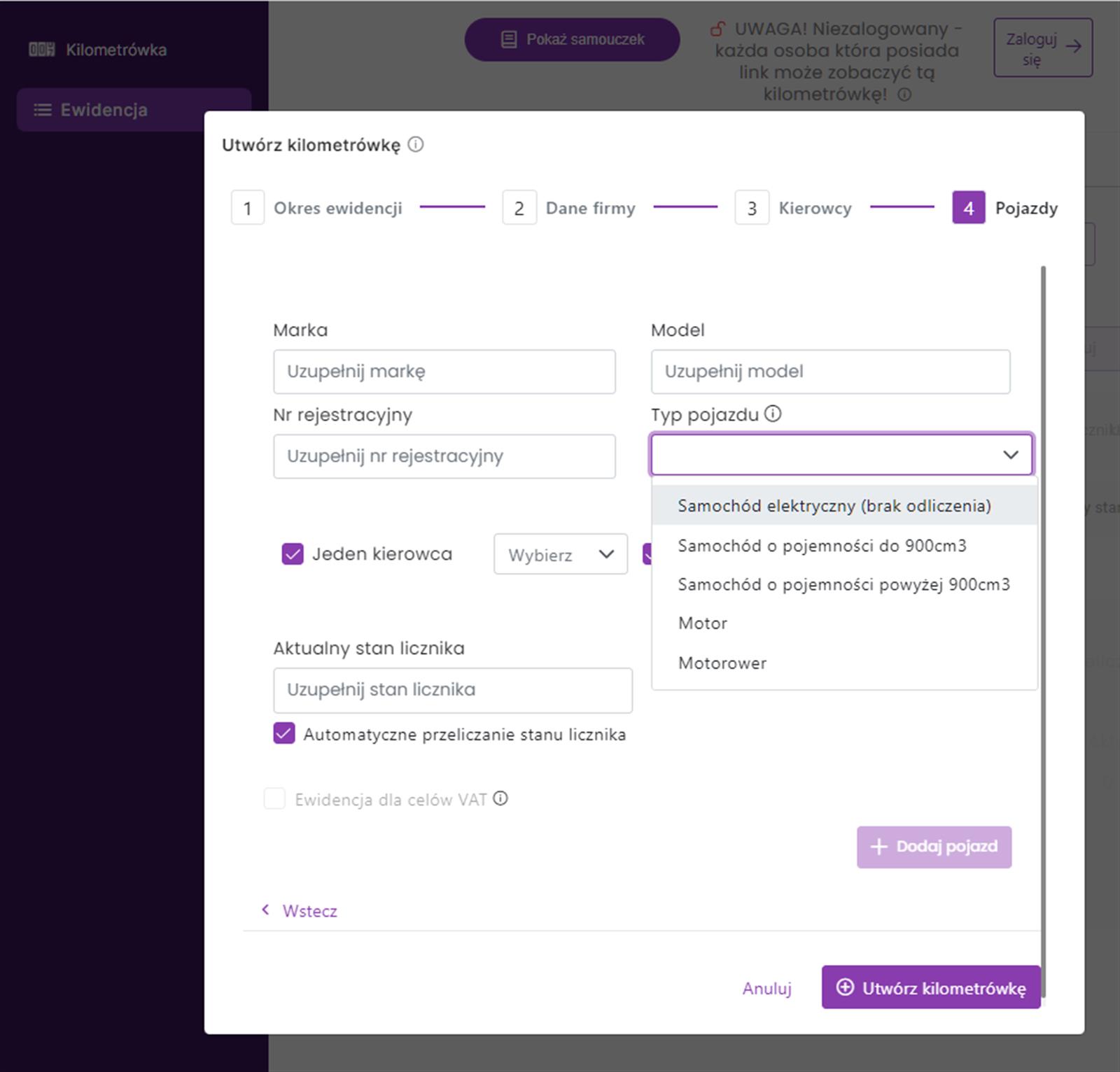

The records can be kept both electronically and "traditionally" - that is, on paper. The photo below shows a finished mileage log printed from the kilometer.net program

Kilometrowka.net allows you to efficiently and effectively account for cars, motorcycles and mopeds used for business purposes. For companies managing a fleet of vehicles, record-keeping allows effective control of costs and tax settlements.

What the mileage log should contain

What should the mileage records look like? The records should contain such information as the odometer balance at the beginning and end of each accounting period, and each individual entry should contain: date, time, place of beginning and ending of the trip, number of kilometers of the trip, name and address of the destination.

An entrepreneur is required to keep mileage records in order to deduct 100% VAT on the use of a vehicle in his business. In the case of a passenger car, there are, as many as two types of rates appropriate to the engine capacity to be included in the statement.

In accordance with the Regulation of the Minister of Infrastructure on the conditions for determining reimbursement of the costs of use of vehicles not owned by the employer for business purposes, the following rates apply for different types of vehicles: PLN 0.42/km for a moped, PLN 0.69/km for a motorcycle, PLN 0.89/km for a passenger car o engine capacities up to 900 cc and PLN 1.15/km for a passenger car with a engine capacities Above 900 cc.

Records are made for each vehicle separately. If you do not continue to keep records, when filling out the last statement, you should fill in the date on which you stopped keeping mileage records.

How to keep mileage records

Recordkeeping, commonly known as mileage, is not only a tax obligation, but also a practical tool for controlling the cost of business income. In order for the records to be reliable and meet the requirements of the tax office, care must be taken to ensure that they are systematic and complete. Each entry should be made on an ongoing basis, preferably at the end of each business trip, thus avoiding mistakes and missing documentation.

It is worth keeping mileage records electronically, which makes it much easier to retrieve information and archive data. Electronic mileage records allow you to quickly check the number of kilometers, the registration number of the vehicle or the purpose of the trip, and easily prepare statements for tax purposes. Regardless of the form you choose, remember to keep the records for the period required by tax regulations, so that in the event of an audit you can document all costs associated with the operation of the vehicle.

It is also crucial that the records cover the entire period of use of the vehicle in the business - from the date of commencement to the end of record-keeping. This makes it possible to accurately account for all kilometers driven and related expenses.

Keep your records faster and more efficiently with kilometer.net.

Mileage records vs. vat declaration

An entrepreneur must keep mileage records of vehicles not owned by the employer, but used for business purposes. The records should contain all the necessary information. The data that such mileage records must contain is described in Article 23(7) of the Personal Income Tax Law.

The entrepreneur must provide the tax office with a completed VAT-26 return.

Expenses accounted for under mileage records

An entrepreneur can deduct 100% of deductible expenses if he keeps records. Deductible expenses are business expenses that are related to the operation of vehicles. Deductible expenses are costs that are related to the business.

If the vehicle owned by the business has been lent as a short-term rental, the taxpayer should properly include this in the mileage accounting. Such a situation should have an appropriate contract, which will designate the rate for the use of the vehicle, the signature of the person driving the vehicle and the day of return of the vehicle. In such a case, higher rates can be set for the use of the vehicle.

Mileage records for tax purposes

Until the end of 2018, mileage records were required for entrepreneurs who wanted to recognize as a deductible expense the expenses associated with using a car for business purposes in the business.

The obligation to keep records was abolished as of January 1, 2019. From the same date, the regulations on the use of private cars for company purposes have changed significantly. The mileage allowance for company-owned cars has also ceased to apply to under a lending agreement or short-term rentals. In this case, the limit for recognizing expenses as a business expense reaches 75%.

As of January 17, 2023, new mileage rates took effect, which are adequate for current fuel and other prices vehicle operating costs. Mileage rate is set at an amount that covers both fuel consumption and some of the vehicle's operating costs.

Vehicle mileage records vs. billing

Vehicle records play an important role in an entrepreneur's tax returns. It is on the basis of it that it can be shown that the expenses incurred for the operation of a vehicle are related to business activity and constitute revenue costs. Properly kept records make it possible to deduct these costs in the annual settlement, which translates into real tax savings.

However, in order to exercise this right, the records must be kept accurately and in accordance with applicable regulations. Any shortcomings, inaccuracies or irregularities in the records may result in the tax office questioning the costs and, consequently, losing the right to deduct deductible expenses or even imposing financial sanctions. That's why it's so important to keep records up to date, keep all documents confirming the expenses incurred and ensure compliance with tax regulations.

The photo below shows a sample listing in the program mileage.net.

Systematic and accurate maintenance of mileage records is not only an obligation, but also a guarantee of tax security and the ability to take full advantage of the allowances.

Mileage records vs. proper billing

Proper accounting for expenses related to the use of a vehicle in business requires meticulous maintenance of mileage records. Only a complete and compliant record allows you to seamlessly account for all kilometers driven and related expenses.

In practice, this means that the records must be systematically supplemented with each route, including the start and end dates of the records, the number of kilometers traveled and the purpose of the trip. The day of completion should be accurately indicated, which allows you to accurately close the accounting period and avoid misunderstandings during a tax audit.

With proper record-keeping, the entrepreneur gains confidence that all costs have been properly documented and can be deducted in the tax return. This not only makes it easier to manage the company's finances, but also minimizes the risk of disputes with the tax office and allows you to take full advantage of tax benefits.

Completion

The mileage log is an important document in business. It applies to various types of vehicle including: passenger cars, motorcycles and mopeds not owned by the employer. What the vehicle mileage records should include: the date you start keeping records, the date you stop keeping records, vehicle registration number, engine displacement, rate per kilometer driven, engine capacity, odometer reading, route description, number of kilometers driven.

Proper recordkeeping of a vehicle for business purposes allows 100% VAT and deductible expenses to be deducted.

Mileage records should be kept in accordance with the requirements of tax regulations. Unfortunately, updated regulations of the Minister of Infrastructure can lead to an incorrect calculation of mileage. It is worth remembering that each changing regulation may affect the following mileage rates, which should be regularly updated in the records. Therefore, if you do not want to constantly keep track of the following rates for the use of a private or company car, use our program mileage.net.

- Mileage logbook - how to fill it in correctly?

- Obligation to keep records

- Vehicle mileage records and their relationship to employees

- What the mileage log should contain

- How to keep mileage records

- Mileage records vs. vat declaration

- Expenses accounted for under mileage records

- Mileage records for tax purposes

- Vehicle mileage records vs. billing

- Mileage records vs. proper billing

- Completion